South Dakota v. Wayfair, Inc.

New sales tax rules for remote (online and off-line) sellers

What remote sellers need to know

On June 21, 2018, the Supreme Court of the United States ruled in favor of the state in South Dakota v. Wayfair, Inc. The decision allows states to tax remote sales. What does it mean for out-of-state sellers?

It used to be that states could only tax sales by businesses with a physical presence in the state. Now economic activity in a state — economic nexus — can trigger a sales tax collection obligation. Economic nexus is based entirely on sales revenue, transaction volume, or a combination of both.

South Dakota blazed the trail, and other states are following close behind. Here’s a look at how the court’s decision is changing the world of sales tax compliance.

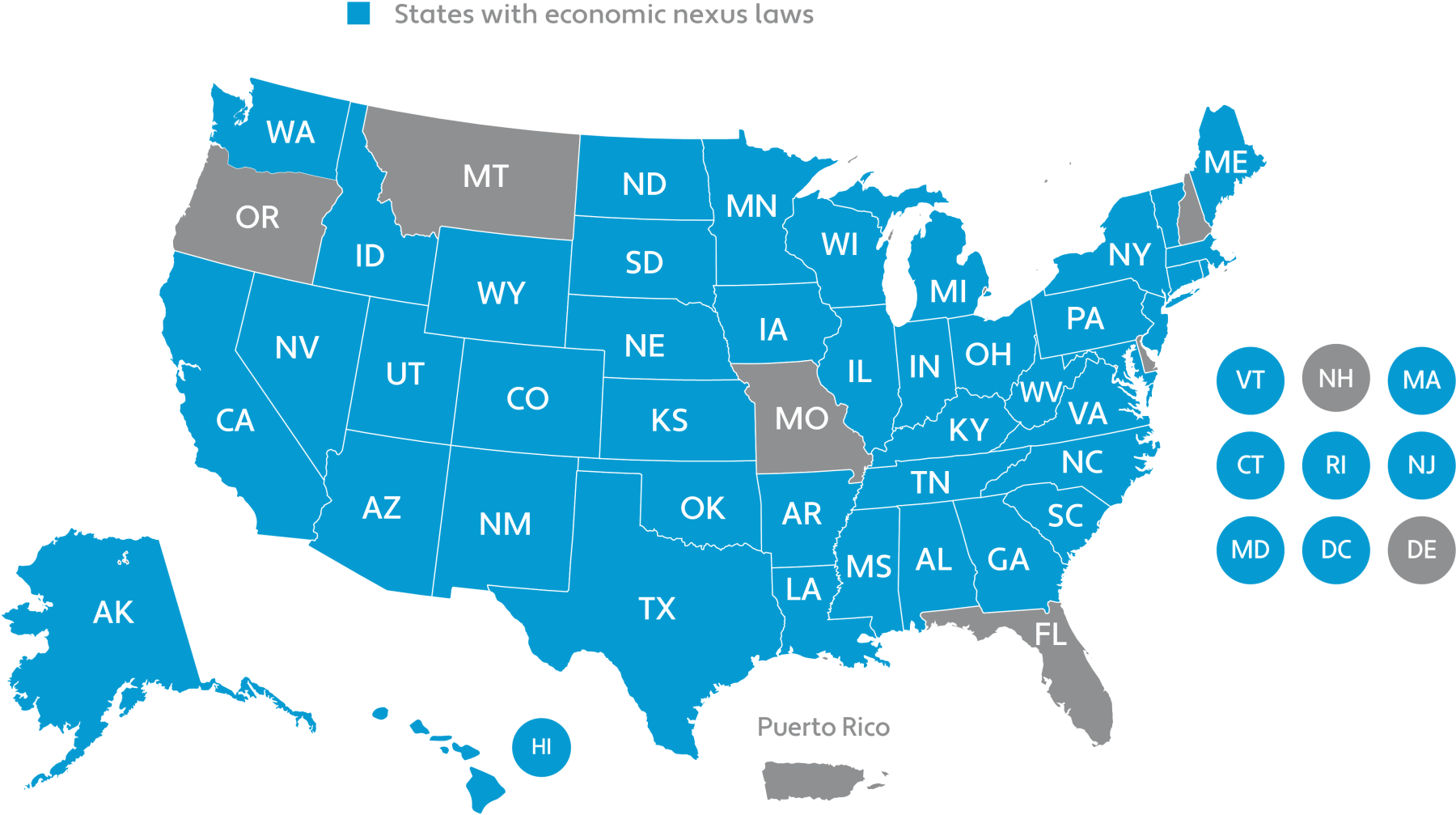

Remote seller nexus by state

as of August 22, 2019

Economic nexus is sweeping the nation in the wake of South Dakota v. Wayfair, Inc. In fact, most states now have an economic nexus law or rule on the books, and each is unique.

Yet states also tax remote sales based on affiliate nexus and click-through nexus. Some states impose notice and reporting requirements on non-collecting sellers. And a growing number of states are requiring marketplace facilitators to collect and remit tax on behalf of third-party sellers.

For at-a-glance maps and an in-depth look at affiliate nexus, click-through nexus, economic nexus, marketplace facilitator laws, and non-collecting seller use tax reporting, see our new Sales tax laws by state resource page.

Click here for a state-by-state guide to sales tax economic nexus rules.

More questions? Read our full FAQ here.

Remote seller nexus thresholds

as of August 9, 2019

| Sales tax states | Economic nexus effective date | Economic nexus thresholds triggering a collection obligation ($ and/or transaction volume) | Transaction included in economic nexus threshold test | Other forms of remote seller nexus, with effective date |

|---|---|---|---|---|

| More than $250,000 | Retail sales of products* delivered into the state | Non-collecting seller use tax reporting: 1.1.2019 Tax on marketplace sales: 1.1.2019 | ||

More than $200,000 for calendar year 2019; more than $150,000 for calendar year 2020; and more than $100,000 for calendar year 2021 and subsequent calendar years | Gross proceeds of sales of products* or gross income derived from business in the state (excluding marketplace sales) | Tax on marketplace sales: 9.20.2016; updated effective 10.1.2019 | ||

More than $100,000 | Sales of products*, services, digital codes, or specified digital products that are subject to Arkansas sales or use tax and delivered into the state | Affiliate/Click-through nexus: 2011; eliminated effective 7.1.2019 Tax on marketplace sales: 7.1.2019 | ||

More than $500,000 | Sales of taxable and non-taxable property* for delivery into the state, including sales by affiliates/subsidaries | Affiliate/Click-through nexus: 2011; repealed effective 4.1.2019 Tax on marketplace sales: 10.1.2019 | ||

| $100,000 or more | Retail sales or services delivered into the state, including exempt sales | Affiliate/Click-through nexus: 2014; repealed effective 6.1.2019 Non-collecting seller use tax reporting: 7.1.2017 Tax on marketplace sales: 10.1.2019 | ||

At least $250,000 Effective 7.1.2019, threshold changes to: At least $100,000

| Retail sales of products* and services delivered into the state | Non-collecting seller use tax reporting for referrers: 12.1.2018, with additional requirements effective 7.1.2019 Tax on marketplace sales: 12.1.2018 | ||

|

|

| ||

| More than $250,000 ($100,000 as of 1.1.2020) or 200 or more retail sales | Retail sales of products* delivered into the state electronically or physically | Affiliate/Click-through nexus: 2012 Non-collecting seller use tax reporting: 1.1.2019 (eliminated as of 1.1.2020) | ||

| At least $100,000 or 200 or more separate transactions | Gross income or gross proceeds of products*, intangible property, or services used/consumed or delivered in the state | Non-collecting seller use tax reporting: 1.1.2020 Tax on marketplace sales: 1.1.2020 | ||

More than $100,000 | Sales delivered into Idaho | Click-through nexus: 7.1.2018 Tax on marketplace sales: 6.1.2019 | ||

| At least $100,000 or 200 or more separate sales | Sales of products* in the state, including exempt sales but not sales for resale or occasional sales | Affiliate nexus: 2011 Click-through nexus: 2015 Tax on marketplace sales: 1.1.2020 | ||

| More than $100,000 or 200 or more separate transactions | Sales of products*, electronically transferred products, or services delivered in the state | Tax on marketplace sales: 7.1.2019 | ||

| At least $100,000 or 200 or more separate transactions; transaction threshold removed as of 7.1.2019 | Sales of products*, services, or specified digital products into the state | Affiliate nexus: 2013 Cookie nexus: 1.1.2019 Tax on marketplace sales: 1.1.2019 | ||

Appears to apply to any remote seller making sales in the state | The state has not specified | Affiliate/Click-through nexus: 2013 | ||

| More than $100,000 or 200 or more separate transactions | Sales of products* or digital property delivered or transferred electronically into the state | Non-collecting seller use tax reporting: 7.1.2013 (repealed effective 7.1.2019) Tax on marketplace sales: 7.1.2019 | ||

| More than $100,000 or 200 or more separate transactions | Sales of products*, products transferred electronically, or taxable services delivered into the state | Affiliate/Click-through nexus: 2016 Non-collecting seller use tax reporting: 7.1.2017 | ||

| More than $100,000 or 200 or more separate transactions | Gross revenue of all products*, electronically transferred products, or taxable services delivered into the state | Affiliate/Click-through nexus: 2013 Tax on marketplace sales: 10.1.2019 | ||

| More than $100,000 or 200 or more separate transactions | Sales of products* or taxable services delivered into the state | Tax on marketplace sales: 10.1.2019 | ||

More than $100,000 | Sales of taxable and exempt products* and services delivered into the state | Cookie nexus: 10.1.2017 Tax on marketplace sales: 10.1.2019 | ||

| At least $100,000 or 200 or more separate sales | Sales of products* or services in the state | Affiliate/Click-through nexus: 2015 | ||

10 or more retail sales totaling more than $100,000 Threshold changes to more than $100,000 in sales or 200 transactions effective 10.1.2019 | Retail sales from outside Minnesota into the state | Affiliate nexus: 2013 Click-through nexus: 7.1.2019 Tax on marketplace sales: 10.1.2018; amended effective 10.1.2019 | ||

| More than $250,000 and systematic exploitation of the market in the state | Sales of products* and services into the state (retail, wholesale, and exempt) |

| ||

|

|

| Affiliate/Click-through nexus: 2013 | |

| More than $100,000 or 200 or more separate transactions | Retail sales into the state (all sales other than resales) | Tax on marketplace sales: enacted 4.1.2019 | ||

| More than $100,000 or 200 or more separate transactions | Retail sales of products* into the state | Affiliate/Click-through nexus: 2015 Tax on marketplace sales: 10.1.2019 | ||

| More than $100,000 or 200 or more separate transactions | Gross revenue of products,* specified digital products, or services delivered in the state | Click-through nexus: 2014 Tax on marketplace sales: 11.1.2018 | ||

At least $100,000 | Taxable gross receipts from sales, leases, and licenses of products*, and sales of licenses and services of licenses for use of real property sourced to the state | Tax on marketplace sales: 7.1.2019 | ||

Effective "immediately" after the Wayfair ruling, 6.21.2018; however, no clearly stated effective date is currently provided | More than $500,000 | Gross sales of products* delivered into the state | Affiliate/Click-through nexus: 2008 Tax on marketplace sales: 6.1.2019 | |

| More than $100,000 or 200 or more separate transactions | Sales of products* or digital property sourced to North Carolina | Click-through nexus: 2009

| ||

| More than $100,000 | Taxable products* and services in the state | Tax on marketplace sales: 10.1.2019 | ||

| More than $100,000 or 200 or more separate transactions | Taxable and exempt sales of products and services in the state | Affiliate/click-through nexus: 2015; click-through nexus repealed effective 8.1.2019 Cookie nexus: 1.1.2018; repealed effective 8.1.2019 Tax on marketplace sales: 8.1.2019 | ||

At least $100,000 | Aggregate sales of products* delivered into the state | Affiliate nexus: 2016 Non-collecting seller use tax reporting: 7.1.2018 Tax on marketplace sales: 7.1.2018 | ||

More than $100,000 | Gross sales in the Commonwealth | Affiliate/Click-through nexus: 2011 Non-collecting seller use tax reporting: 3.1.2018 (additional requirements 4.1.2019) Tax on marketplace sales: 3.1.2018 (additional requirements 4.1.2019); updated 7.1.2019 | ||

| More than $100,000 or 200 or more separate transactions | Gross revenue of products*, prewritten computer software and vendor-hosted prewritten software delivered electronically or by load and leave, and/or taxable services | Affiliate/Click-through nexus: 8.17.2017 Cookie nexus: 8.17.2017 Non-collecting seller use tax reporting: 1.15.2018 Tax on marketplace sales: 8.17.2017 / new requirements 7.1.2019 | ||

More than $100,000 | Gross revenue of all products*, electronically transferred products, or services delivered into the state, whether taxable or exempt | Tax on marketplace sales: 11.1.2018 (This is being challenged; the outcome of the lawsuit could impact enforcement); a new law reinforces the earlier rule as of 4.26.2019 | ||

| More than $100,000 or 200 or more separate transactions | Taxable and exempt sales of products*, electronically transferred products, or services delivered into the state | Non-collecting seller use tax reporting: 2011 Tax on marketplace sales: 3.1.2019 | ||

| More than $500,000 and systematic solicitation of sales in the state | Taxable products* and taxable services into the state | Affiliate nexus: 2014 Click-through nexus: 2015 | ||

$500,000 | Sales of taxable and exempt products* and services into the state | Affiliate nexus: 2012 Tax on marketplace sales: 10.1.2019 | ||

| More than $100,000 or 200 or more separate transactions | Sales of products*, electronically transferred products, or services delivered into the state | Affiliate nexus: 2012 Tax on marketplace sales: 10.1.2019 | ||

| At least $100,000 or 200 or more individual sales transactions and systematic solicitation of sales in the state | Taxable and nontaxable sales into the state | Click-through nexus: 2015 Non-collecting seller use tax reporting: 7.1.2017 Tax on marketplace sales: 6.1.2019 | ||

More than $100,000 | Retail sales into the state, including sales by members of same controlled group of corporations | Affiliate nexus: 2013 Tax on marketplace sales: 6.1.2017; new law takes effect 7.1.2019

| ||

10.1.2018 (for remote transactions); requirements change 3.15.2019 7.1.2017 (for B&O tax only) | More than $100,000 More than $267,000 of yearly gross receipts sourced or attributed to WA in 2017, $285,000 in 2018 Effective 1.1.2020, the economic nexus threshold for B&O tax will change to $100,000

| Annual gross retail sales/cumulative receipts into the state, including exempt sales; effective 1.1.2020, that changes to cumulative gross income in the state

| Click-through nexus: 2015; eliminated effective 3.15.2019 Non-collecting seller use tax reporting: 1.1.2018; eliminated effective 7.1.19 Tax on marketplace sales: 1.1.2018; new requirements effective 10.1.2018 and 7.1.2019

| |

| More than $100,000 or 200 or more separate transactions | Sales of taxable and nontaxable products* and services | Affiliate nexus: 2014 Tax on marketplace sales: 7.1.2019 | ||

| More than $100,000 or 200 or more separate transactions | Annual gross sales of taxable and nontaxable products* and services | Tax on marketplace sales: 10.1.2019 | ||

| More than $100,000 or 200 or more separate transactions | Taxable, exempt, and wholesale sales of products*, admissions, or services delivered into the state | Tax on marketplace sales: 7.1.2019 | ||

| More than $100,000 or 200 or more separate transactions | Taxable products* and taxable services, including digital property | Tax on marketplace sales: 4.1.2019 |

* State sales tax laws generally use the term "tangible personal property" (TPP). TPP is property that can be perceived by the senses, i.e., seen, weighed, measured, felt, or touched. For simplicity, we're using "products."

Use the South Dakota v. Wayfair filter to watch expert videos and get answers to the following questions and more:

- Could other states follow South Dakota's lead?

- What can out-of-state sellers do now to prepare?

- Why should companies automate sales tax?

More questions? Ask the experts.

Avalara can help you

Avalara's Tax Advisory Services team can help. Our group of experts can help you determine where you have nexus, help you register in new states and jurisdictions, and navigate the full range of sales tax laws.